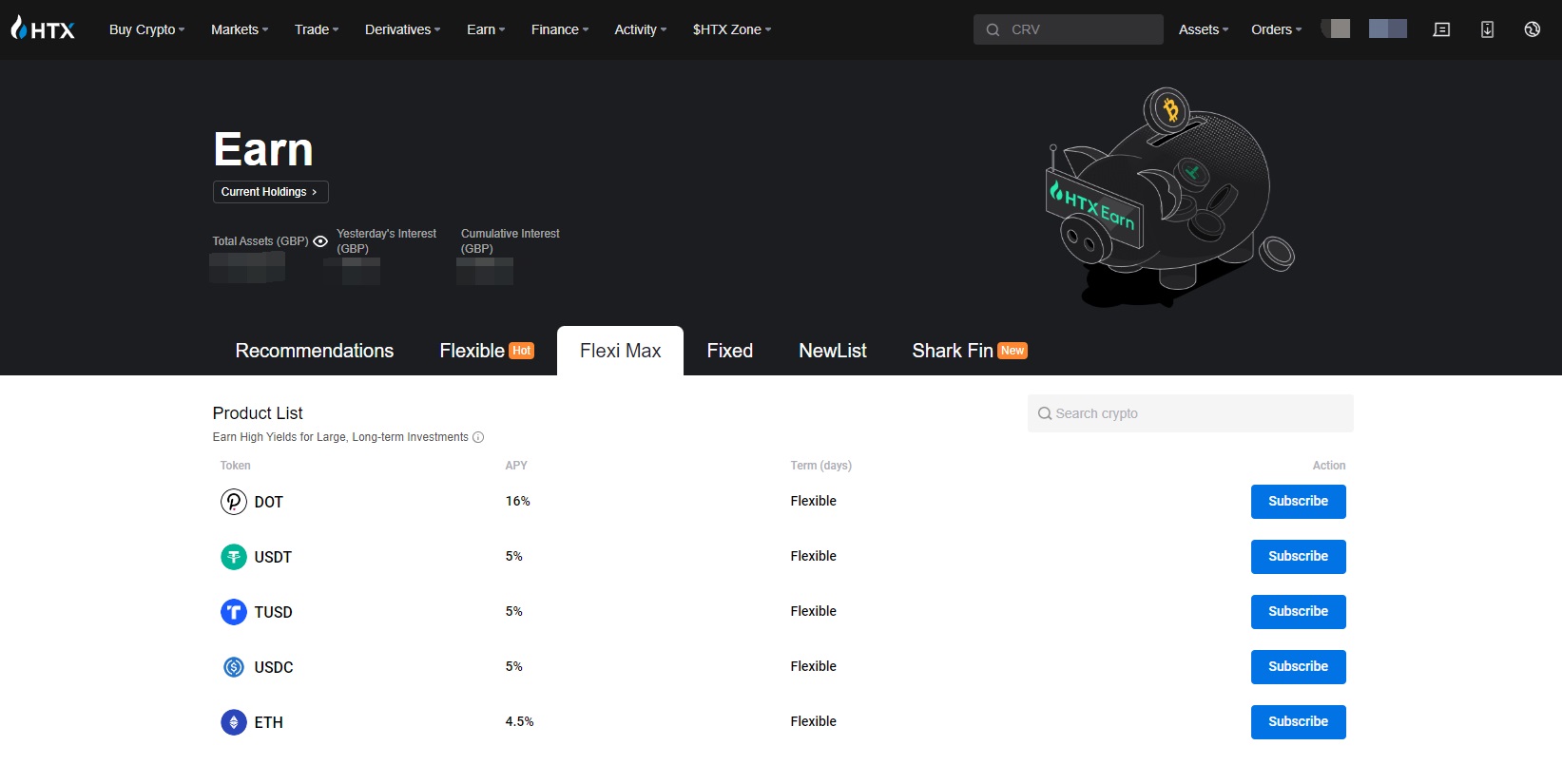

HTX Crypto Exchange has a range of different DeFi Products (De-centralised Finance) and Flexi Max is one of the interest ones.

TLDR; you can transfer your Crypto coins (e.g. USDT) and subscript to Flexi Maxi product.

After subscription, you can withdraw your funds at any time, however, different rates apply, if you hold your funds longer than 365 days, there is no fees.

Compared to Flexible Defis where you can withdraw the funds anytime without any penality, the Flexi Maxi offers a higher interest rates. Compared to Fixed Defis, where you cannot withdraw (redemption) before the mature, Flexi Maxi allows you to withdraw, at the cost of some fees. The longer your funds stay in the pool, the more interests and less redemption rates. For Flexi Maxi, the funds are not locked compared to Fixed.

Here is the detail comparisons:

| Plan | Pros | Cons |

| Flexible | Redemption anytime | Lower interest rates |

| Fixed | Higher interest rates | Funds are locked before mature |

| Flexi Maxi | Higher interest rates Funds can be redeemed |

Higher redemption fees if withdraw in short amount of time |

HTX Flexi Maxi Subscription Amount

Min amount of this subscription = max((Min investment amount – Your holdings), Min amount per order). The requirement of minimum investment amount applies to subscription, but not to redemption.

Example: If the min investment amount is 250,000 USDT:

- A user must deposit at least 250,000 USDT when subscribing to the product for the first time.

- If a user deposits 300,000 USDT, the user can redeem only a portion, say 200,000 USDT. After redemption, the remaining holdings become 100,000 USDT, lower than the minimum investment amount required.

- The user must deposit at least 150,000 USDT when subscribing to the product again.

Earn High Yields for Large, Long-term Investments

Actual earnings at redemption = Interest – Redemption fee

Holding period = Current date – Date when interest accrues

Interest begins to accrue on the day following the subscription date (UTC+8).

What’s the tiered redemption fee rate?

The redemption fee rates for a Flexi Max product vary depending on the holding period.

Redemption fee rates:

USDT Holding Period

- Fee Rate 0 ~ 180 Days, 0.5% USDTv

- Fee Rate 180 ~ 365 Days, 0.3% USDT

- Fee Rate > 365 Days, 0% USDT

For example:

- A holding period of 120 days corresponds to a redemption fee rate of 0.5%. If you redeem 10,000 USDT, your redemption fee will be 50 USDT (= 10,000 USDT * 0.5%)

- A holding period of more than 180 days lowers the redemption fee rate to 0.2%. If you redeem 10,000 USDT, your redemption fee will be 20 USDT (= 10,000 USDT * 0.2%)

Earning a higher interest rates is one of the Passive Income. However, it is still risky to have coins in the Crypto Exchanges (since most exchanges are centralize aka CEX). So the Flexi Maxi is attractive to investors since they can earn a higher rates and also the funds can be redempted at a small cost.

You are about to purchase a structured product with the American option embedded. lf the index price before seitlement is above or below the knockout price, you’ll only receive a basic return. Conversely, if the knockout price is notbreached, you can earn a higher return, which will be calculated based on thesettlement price at the product’s expiration.

Crypto DeFi (Decentralize Finance)

Please Note: This is not a Financial Advice!. Crypto Investments are risky. Dont' Invest Unless You Do Your Own Research!

- Introduction to Crypto Defi: Flexi Max (HTX)

- Earning Passive Income by Staking Coins (USDT etc) on Wirex X-Accounts

- Passive Income of Earning Up To 12% (APR) Interests on Cryptos

–EOF (The Ultimate Computing & Technology Blog) —

Last Post: Teaching Kids Programming - Introduction to SQL Join Queries (Inner, Left, Right, Full and Cross Joins)

Next Post: The Experience of On-call (Paging) for Amazon Software Engineers